Published: Monday, 21th October 2024

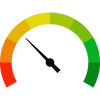

The cost of living in Saint Vincent and the Grenadines is 3.39 times less expensive as compared to Australia.

On this page, you will find side-by-side cost comparison between Saint Vincent and the Grenadines and Australia. We have created 172 cost-of-living indicators. We average the prices of all those indicators and take a mathematically calculated approach to determine which country is more expensive to live in between Saint Vincent and the Grenadines and Australia.

We always try to give you the latest data, but sometimes mistakes might occur. If you think some content on our site is not updated, please let us know by emailing us at: info.comparedoo@gmail.com

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

1 BHK Apartment in City Center  | 2,200 XCD (814.88 USD) | 2,500 AUD (1,598.50 USD) |

2 BHK Apartment in City Center  | 3,500 XCD (1,296.40 USD) | 3,500 AUD (2,237.90 USD) |

3 BHK Apartment in City Center  | 5,000 XCD (1,852 USD) | 4,500 AUD (2,877.30 USD) |

1 BHK Apartment outside City Center  | 1,500 XCD (555.60 USD) | 1,800 AUD (1,150.92 USD) |

2 BHK Apartment outside City Center  | 2,500 XCD (926 USD) | 2,500 AUD (1,598.50 USD) |

3 BHK Apartment outside City Center  | 3,500 XCD (1,296.40 USD) | 3,200 AUD (2,046.08 USD) |

Mortgage Rates Per Month  | 8 % | 4.5 % |

Realtor Commission  | 2 % | 2.5 % |

Property Taxes  | Yet to Update | 0.3 to 1.75 % |

The average housing cost in Saint Vincent and the Grenadines is 1.73 times less expensive than Australia.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Basic Home Furnishing  | 3,500 XCD (1,296.40 USD) | 1,200 AUD (767.28 USD) |

Electricity Cost Per Month  | 180 XCD (66.67 USD) | 200 AUD (127.88 USD) |

Heating Cost Per Month  | 120 XCD (44.45 USD) | 100 AUD (63.94 USD) |

Cooling Cost Per Month  | 160 XCD (59.26 USD) | 150 AUD (95.91 USD) |

Water Supply Cost Per Month  | 90 XCD (33.34 USD) | 80 AUD (51.15 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 35.61% more for Utilities.

The basic home furnishing in Saint Vincent and the Grenadines costs 1.69 times more compared to Australia.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Standard Wifi Cost Per Month  | 120 XCD (44.45 USD) | 70 AUD (44.76 USD) |

Mobile Phone Basic Plan Cost Per Month  | 100 XCD (37.04 USD) | 50 AUD (31.97 USD) |

Landline Basic Plan Cost Per Month  | 70 XCD (25.93 USD) | 40 AUD (25.58 USD) |

Cable TV Basic Plan Cost Per Month  | 120 XCD (44.45 USD) | 60 AUD (38.36 USD) |

The internet and communication costs 7.96% more in Saint Vincent and the Grenadines compared to Australia.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Long Grain Rice (1 KG)  | 18 XCD (6.67 USD) | 3.50 AUD (2.24 USD) |

Milk (1 Liter)  | 12 XCD (4.44 USD) | 2.50 AUD (1.60 USD) |

Water (1 Liter)  | 4 XCD (1.48 USD) | 1.50 AUD (0.96 USD) |

Bread (500 gm)  | 8 XCD (2.96 USD) | 3 AUD (1.92 USD) |

Eggs (1 Dozen)  | 12 XCD (4.44 USD) | 6.50 AUD (4.16 USD) |

Cheese (1 KG)  | 30 XCD (11.11 USD) | 10 AUD (6.39 USD) |

Chicken Breast (1 KG)  | 35 XCD (12.96 USD) | 15 AUD (9.59 USD) |

In Saint Vincent and the Grenadines, the cost of 1 Liter Water and 1 Liter Milk is 2.32 times more expensive than the cost in Australia.

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 64.13% more for Groceries.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Apples (1 KG)  | 18 XCD (6.67 USD) | 4 AUD (2.56 USD) |

Bananas (1 KG)  | 12 XCD (4.44 USD) | 3 AUD (1.92 USD) |

Oranges (1 KG)  | 14 XCD (5.19 USD) | 4 AUD (2.56 USD) |

Tomatoes (1 KG)  | 12 XCD (4.44 USD) | 5 AUD (3.20 USD) |

Potatoes (1 KG)  | 10 XCD (3.70 USD) | 2.50 AUD (1.60 USD) |

Lemons (1 KG)  | 22 XCD (8.15 USD) | 4.50 AUD (2.88 USD) |

Onions (1 KG)  | 14 XCD (5.19 USD) | 2 AUD (1.28 USD) |

Lentils (1 KG)  | 18 XCD (6.67 USD) | 3 AUD (1.92 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 2.48 times more for Fruits and Vegetables.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Meal at a Resonable Restaurant  | 30 XCD (11.11 USD) | 20 AUD (12.79 USD) |

Three-Course Meal for Two  | 70 XCD (25.93 USD) | 70 AUD (44.76 USD) |

Fast Food Combo Meal  | 18 XCD (6.67 USD) | 12 AUD (7.67 USD) |

Normal Coffee  | 6 XCD (2.22 USD) | 4 AUD (2.56 USD) |

Soft Drink  | 5 XCD (1.85 USD) | 3 AUD (1.92 USD) |

Pizza for One  | 35 XCD (12.96 USD) | 20 AUD (12.79 USD) |

Take-Out Delivery Meal  | 30 XCD (11.11 USD) | 25 AUD (15.98 USD) |

Cigarette Pack of 20  | 18 XCD (6.67 USD) | 25 AUD (15.98 USD) |

Dining-Out costs 31.39% less in Saint Vincent and the Grenadines compared to Australia.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Wine Mid-Range Bottle  | 70 XCD (25.93 USD) | 15 AUD (9.59 USD) |

Glass of Wine  | 18 XCD (6.67 USD) | 8 AUD (5.12 USD) |

Domestic Beer Half Liter  | 9 XCD (3.33 USD) | 4 AUD (2.56 USD) |

Imported Beer Half Liter  | 14 XCD (5.19 USD) | 6 AUD (3.84 USD) |

Domestic Alcohol 1 Liter  | 45 XCD (16.67 USD) | 25 AUD (15.98 USD) |

Branded Alcohol 1 Liter  | 80 XCD (29.63 USD) | 50 AUD (31.97 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 1.27 times more for usual hard drinks.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Monthly Public Transportation Pass  | 180 XCD (66.67 USD) | 150 AUD (95.91 USD) |

Single Public Transportation Ticket  | 6 XCD (2.22 USD) | 4 AUD (2.56 USD) |

Single Train Ticket  | Yet to Update () | 5 AUD (3.20 USD) |

Domestic Airplane Ticket  | 350 XCD (129.64 USD) | 150 AUD (95.91 USD) |

Taxi Start Fare  | 12 XCD (4.44 USD) | 4 AUD (2.56 USD) |

Taxi Rate Per Kilometer  | 4 XCD (1.48 USD) | 2 AUD (1.28 USD) |

Car Rental Per Day  | 180 XCD (66.67 USD) | 70 AUD (44.76 USD) |

Parking Fees in City Center Per Hour  | 12 XCD (4.44 USD) | 5 AUD (3.20 USD) |

Parking Fees outside City Center Per Hour  | 6 XCD (2.22 USD) | 3 AUD (1.92 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 1.11 times more for transportation.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Reasonable Vehicle Purchase Cost  | 35,000 XCD (12,964 USD) | 35,000 AUD (22,379 USD) |

Vehicle Registration Cost  | 600 XCD (222.24 USD) | 500 AUD (319.70 USD) |

Driving License Fees  | 120 XCD (44.45 USD) | 100 AUD (63.94 USD) |

Car Insurance Cost  | 700 XCD (259.28 USD) | 120 AUD (76.73 USD) |

Car Maintenance Cost  | 250 XCD (92.60 USD) | 150 AUD (95.91 USD) |

Car Loan Interest Rates  | 8 % | 6 % |

Fuel Per Liter  | 10 XCD (3.70 USD) | 1.70 AUD (1.09 USD) |

Fuel Per Gallon  | 40 XCD (14.82 USD) | 6.45 AUD (4.12 USD) |

Average Toll Fees  | Yet to Update | 2 AUD 1.28 USD |

You would have to pay 1.69 times less for Vehicle purchase, daily operation and maintenance in Saint Vincent and the Grenadines compared to that of Australia.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Doctor Visit  | 120 XCD (44.45 USD) | 150 AUD (95.91 USD) |

Specialist Visit  | 250 XCD (92.60 USD) | 200 AUD (127.88 USD) |

Dentist Visit  | 180 XCD (66.67 USD) | 150 AUD (95.91 USD) |

Eye Exam  | 60 XCD (22.22 USD) | 70 AUD (44.76 USD) |

Mental Health Counseling  | 150 XCD (55.56 USD) | 100 AUD (63.94 USD) |

Preventive Health Screening  | 100 XCD (37.04 USD) | 150 AUD (95.91 USD) |

Physical Therapy  | 100 XCD (37.04 USD) | 80 AUD (51.15 USD) |

Emergency Room Visit  | 350 XCD (129.64 USD) | 500 AUD (319.70 USD) |

Hospital Stay Per Night  | 180 XCD (66.67 USD) | 1,000 AUD (639.40 USD) |

Vaccinations  | 60 XCD (22.22 USD) | 100 AUD (63.94 USD) |

Prescription Medication  | 50 XCD (18.52 USD) | 30 AUD (19.18 USD) |

Over the Counter Medication  | 25 XCD (9.26 USD) | 10 AUD (6.39 USD) |

Health Insurance Premiums  | 300 XCD (111.12 USD) | 200 AUD (127.88 USD) |

Health Insurance Deductibles  | 250 XCD (92.60 USD) | 100 AUD (63.94 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 2.25 times less for Health and Medical Treatment.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Cosmetic Procedures  | 300 XCD (111.12 USD) | 500 AUD (319.70 USD) |

Spa Treatment  | 180 XCD (66.67 USD) | 150 AUD (95.91 USD) |

Manicure Pedicure Cost  | 50 XCD (18.52 USD) | 50 AUD (31.97 USD) |

Optical Glasses Cost  | 120 XCD (44.45 USD) | 200 AUD (127.88 USD) |

Contact Lenses Cost  | 90 XCD (33.34 USD) | 100 AUD (63.94 USD) |

Haircuts  | 30 XCD (11.11 USD) | 30 AUD (19.18 USD) |

Hair Coloring  | 90 XCD (33.34 USD) | 80 AUD (51.15 USD) |

Shampoo Price  | 12 XCD (4.44 USD) | 5 AUD (3.20 USD) |

Toothpaste Price  | 6 XCD (2.22 USD) | 3 AUD (1.92 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 2.20 times less for Personal Care Items and Treatment.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Pair of Nike Running Shoes  | 220 XCD (81.49 USD) | 150 AUD (95.91 USD) |

Men's Shirt  | 70 XCD (25.93 USD) | 50 AUD (31.97 USD) |

Women's Dress  | 220 XCD (81.49 USD) | 120 AUD (76.73 USD) |

Summer Dress  | 130 XCD (48.15 USD) | 80 AUD (51.15 USD) |

Men's Suit  | 650 XCD (240.76 USD) | 300 AUD (191.82 USD) |

Men's Jeans  | 130 XCD (48.15 USD) | 100 AUD (63.94 USD) |

Women's Jeans  | 130 XCD (48.15 USD) | 80 AUD (51.15 USD) |

Men's Formal Shoes  | 160 XCD (59.26 USD) | 150 AUD (95.91 USD) |

Women's Formal Shoes  | 130 XCD (48.15 USD) | 150 AUD (95.91 USD) |

Men's Casual Shoes  | 110 XCD (40.74 USD) | 120 AUD (76.73 USD) |

Women's Casual Shoes  | 90 XCD (33.34 USD) | 90 AUD (57.55 USD) |

Underwear For Men  | 25 XCD (9.26 USD) | 20 AUD (12.79 USD) |

Underwear For Women  | 30 XCD (11.11 USD) | 25 AUD (15.98 USD) |

Socks For Men  | 12 XCD (4.44 USD) | 10 AUD (6.39 USD) |

Socks For Women  | 12 XCD (4.44 USD) | 10 AUD (6.39 USD) |

Wintercoat for Adults  | 220 XCD (81.49 USD) | 200 AUD (127.88 USD) |

Sportswear  | 130 XCD (48.15 USD) | 70 AUD (44.76 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 1.21 times less for Clothing and Footwear for Adults.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Children's Jeans  | 70 XCD (25.93 USD) | 40 AUD (25.58 USD) |

Children's Normal Sneakers  | 90 XCD (33.34 USD) | 50 AUD (31.97 USD) |

Children's Winter Coat  | 130 XCD (48.15 USD) | 100 AUD (63.94 USD) |

Daycare for Infant  | 850 XCD (314.84 USD) | 1,200 AUD (767.28 USD) |

Daycare for Toddler  | 650 XCD (240.76 USD) | 1,000 AUD (639.40 USD) |

Childcare for Sick Days  | 60 XCD (22.22 USD) | 100 AUD (63.94 USD) |

Early Childhood Education Programs  | 320 XCD (118.53 USD) | 1,000 AUD (639.40 USD) |

Extra Curricular Activities  | 220 XCD (81.49 USD) | 300 AUD (191.82 USD) |

Summer Camp for Kids  | 320 XCD (118.53 USD) | 500 AUD (319.70 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 2.73 times less for Childcare and kids clothing.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

PreSchool Fees  | 1,100 XCD (407.44 USD) | 800 AUD (511.52 USD) |

Primary School Fees  | 1,300 XCD (481.52 USD) | 1,000 AUD (639.40 USD) |

Secondary School Fees  | 1,600 XCD (592.64 USD) | 1,500 AUD (959.10 USD) |

Private School Fees  | 2,100 XCD (777.84 USD) | 20,000 AUD (12,788 USD) |

University Tuition Fees  | 2,700 XCD (1,000.08 USD) | 30,000 AUD (19,182 USD) |

University Private Tuition Fees  | 3,200 XCD (1,185.28 USD) | 40,000 AUD (25,576 USD) |

After School Activities  | 120 XCD (44.45 USD) | 200 AUD (127.88 USD) |

Special Education Services  | 320 XCD (118.53 USD) | 800 AUD (511.52 USD) |

Tutoring  | 90 XCD (33.34 USD) | 50 AUD (31.97 USD) |

Textbooks Cost  | 110 XCD (40.74 USD) | 300 AUD (191.82 USD) |

School Supplies  | 60 XCD (22.22 USD) | 100 AUD (63.94 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 12.88 times less for school and education.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Movie Ticket (Single)  | 18 XCD (6.67 USD) | 20 AUD (12.79 USD) |

Theater Ticket (Single)  | 35 XCD (12.96 USD) | 50 AUD (31.97 USD) |

Concert Ticket (Single)  | 60 XCD (22.22 USD) | 100 AUD (63.94 USD) |

Sports Event Ticket (Single)  | 70 XCD (25.93 USD) | 60 AUD (38.36 USD) |

Gym Membership  | 120 XCD (44.45 USD) | 70 AUD (44.76 USD) |

Swimming Pool Access  | 90 XCD (33.34 USD) | 10 AUD (6.39 USD) |

Museum Entry Ticket  | 12 XCD (4.44 USD) | 20 AUD (12.79 USD) |

Zoo Entry Ticket  | 18 XCD (6.67 USD) | 30 AUD (19.18 USD) |

Amusement Park Entry Ticket  | 35 XCD (12.96 USD) | 80 AUD (51.15 USD) |

Bowling  | 22 XCD (8.15 USD) | 20 AUD (12.79 USD) |

Mini Golf  | 18 XCD (6.67 USD) | 15 AUD (9.59 USD) |

Video Games  | 55 XCD (20.37 USD) | 80 AUD (51.15 USD) |

Streaming Services  | 22 XCD (8.15 USD) | 15 AUD (9.59 USD) |

Outdoor Equipment Rental  | 35 XCD (12.96 USD) | 30 AUD (19.18 USD) |

Theme Park Annual Pass  | 550 XCD (203.72 USD) | 250 AUD (159.85 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 1.26 times less for entertainment, recreation and fun activities.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Language Classes  | 270 XCD (100.01 USD) | 400 AUD (255.76 USD) |

Parenting Classes  | 220 XCD (81.49 USD) | 150 AUD (95.91 USD) |

Art Classes  | 35 XCD (12.96 USD) | 30 AUD (19.18 USD) |

Fitness Classes  | 25 XCD (9.26 USD) | 20 AUD (12.79 USD) |

Music Lessons  | 55 XCD (20.37 USD) | 50 AUD (31.97 USD) |

Dance Lessons  | 55 XCD (20.37 USD) | 40 AUD (25.58 USD) |

Reading Materials for Classes  | 18 XCD (6.67 USD) | 15 AUD (9.59 USD) |

Educational Software  | 180 XCD (66.67 USD) | 200 AUD (127.88 USD) |

If you lived in Saint Vincent and the Grenadines, instead of Australia, you would have to pay 1.82 times less for Private Classes.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Average Gross Monthly Salary  | 3,500 XCD (1,296.40 USD) | 6,000 AUD (3,836.40 USD) |

Average Net Monthly Salary  | 2,400 XCD (888.96 USD) | 4,800 AUD (3,069.12 USD) |

Minimum Wages  | 40 XCD per hour (14.82 USD) | 66.67 AUD per hour (42.63 USD) |

Average Bonus  | 1,000 XCD (370.40 USD) | 2,000 AUD (1,278.80 USD) |

Income Tax Rate  | 0 to 15 % | 0 to 10 % |

Social Security Contributions  | 5 % | 9.5 % |

Pension Contributions  | 5 % | 9.5 % |

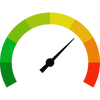

Cost of Living Index  | 55 | 70 |

Median Household Income  | 2,400 XCD (888.96 USD) | 8,000 AUD (5,115.20 USD) |

If you lived in Saint Vincent and the Grenadines, you would earn 3.86 times less salary as compared to Australia.

Indicators  |  Saint Vincent and the Grenadines  |  Australia  |

|---|---|---|

Legal Consultation Per Hour Rate  | 150 XCD (55.56 USD) | 300 AUD (191.82 USD) |

Accounting Services Per Hour Rate  | 100 XCD (37.04 USD) | 150 AUD (95.91 USD) |

IT Support Services Per Hour Rate  | 120 XCD (44.45 USD) | 100 AUD (63.94 USD) |

Technician Services Per Hour Rate  | 100 XCD (37.04 USD) | 80 AUD (51.15 USD) |

Professional Services cost 2.31 times less in Saint Vincent and the Grenadines, as compared to Australia.

We hope you enjoyed the detailed guide on the cost of living comparsion between Saint Vincent and the Grenadines and Australia.

For more side-by-side comparsion between Countries, States and Cities, you can use the search box above or click the links below.

The Comparedoo.com family sincerely appreciates your time with us. We look forward to seeing you on our other pages.